Mpesa VISA Card: Is a VISA virtual card that is linked to your M-PESA wallet. The Mpesa VISA Card enables you to make payments to International online merchants for goods and services using your card details.

This Card cannot be a credit card or a charge card; nor is it a debit card linked to a current M-Pesa account; it is a virtual card generated via an M-Pesa channel (i.e. STK or USSD or App) by an M-Pesa User, meaning that money, must be top up onto the Card at the time of creation or purchase. Users shall not receive a physical card; Users will be sent Card’s credential via SMS containing the Virtual Card number, Expire date, and CVV-Card Verification Value, also may include other relevant information to allow them to use the card online.

The card includes a 16-digit card number, the card’s expiry date (mm/yy), and the security code also referred to as CVV.

What is a CVV? (Card Verification Value)

This is a security feature that enables merchant sites to ensure you are the real owner of the card to reduce fraudulent activities on your Mpesa VISA Card.

A CVV is generated by the customer during the payment process, to verify the payment.

All CVV generated will only be valid for 30 minutes. This will prevent anyone who has your card details from using your card because they may have to generate another CVV.

M-Pesa

M-Pesa is a mobile money platform that offers digital payment services through a user’s SIM card. M-Pesa is similar to peer-to-peer payment platforms in that it also lets users send, receive, and hold money in their accounts.

However, M-Pesa transactions are sent via SMS messages and no bank account is required to use the service.

Getting Started: How to get started with M-Pesa

- Visit any authorised M-PESA agent and get registered

- You will receive an SMS confirming your registration

Now you can

- Send and receive money

- Receive cash through Western Union

- Pay all your bills

- Purchase airtime

M-Pesa Agent Withdrawals: Withdrawal cash from M-Pesa wallet from over 106,000 agents across Tanzania

M-Pesa Phone and ATM Withdrawal

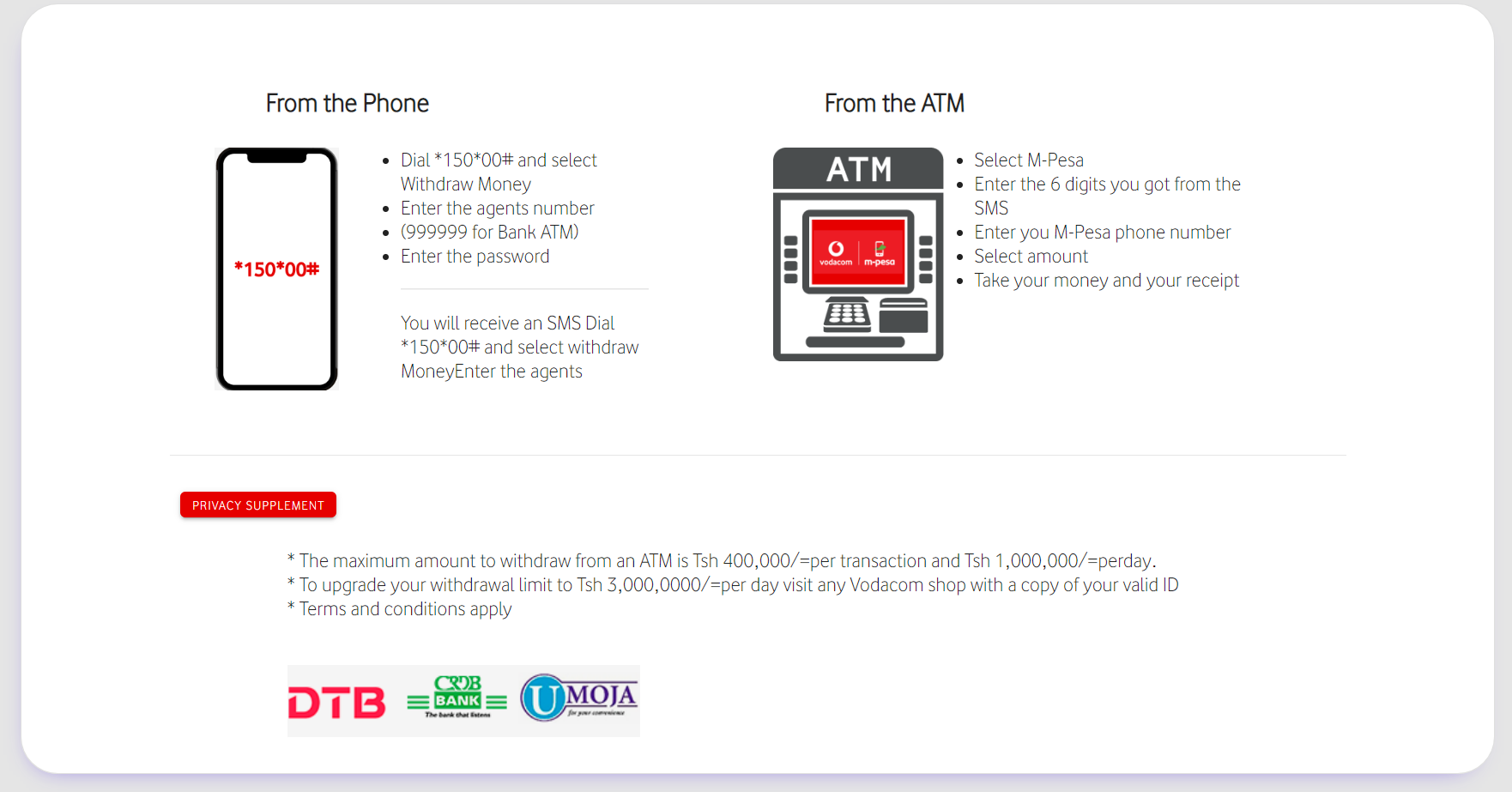

From the Phone

- Dial *150*00# and select Withdraw Money

- Enter the agents number

- (999999 for Bank ATM)

- Enter the password

- You will receive an SMS Dial *150*00# and select withdraw MoneyEnter the agents

From the ATM

- Select M-Pesa

- Enter the 6 digits you got from the SMS

- Enter your M-Pesa phone number

- Select Amount

- Take your money and your receipt

* The maximum amount to withdraw from an ATM is Tsh 400,000/=per transaction and Tsh 1,000,000/=perday.

* To upgrade your withdrawal limit to Tsh 3,000,0000/=per day visit any Vodacom shop with a copy of your valid ID

* Terms and conditions apply

How to create Your Mpesa VISA Card in Tanzania?

Follow the steps below to Create A new Mpesa Visa Card.

- Dial *150*00 # M-Pesa USSD

- Select Option number 4 Pay by M-Pesa.

- Select Option number 6 Mpesa VISA card

- Select Option Number 1 Create Card

- Upon successful card creation you will receive an SMS with card details.

How can I access this service?

On M-PESA USSD (*150*00#):

- Dial *150*00# M-Pesa USSD

- Select Pay by M-Pesa (Option 4)

- Select M-PESA Visa Card (Option 6)

- Upon successful selection, you will find the Following Options ( Create a card,

View card details, Refund Card, Check balance, My Card and Support )

On M-PESA APP:

- Log in to your M-PESA APP.

- Select the Services tab

- Select M-PESA Visa Card

- Click on create M-PESA Visa Card

- You will then receive your card details.

A Final word

M-Pesa can broaden its acceptance network with Visa. The partnership will let M-Pesa users make digital payments across Visa’s network of over 100 million merchants. Previously, M-Pesa users were confined to transacting within the system’s network merchants.

M-Pesa’s tie-up with Visa can increase the system’s utility by giving users a wider purchasing network, which also helps boost the system’s revenue potential.

That is all about creating and accessing M-PESA Visa Card for Online purchases, Thanks for Reading – Check out more articles here

USA

USA UAE

UAE TZ

TZ

Discussion about this post